Florida Medicare Supplements

What you should know about Medicare Supplements in Florida:

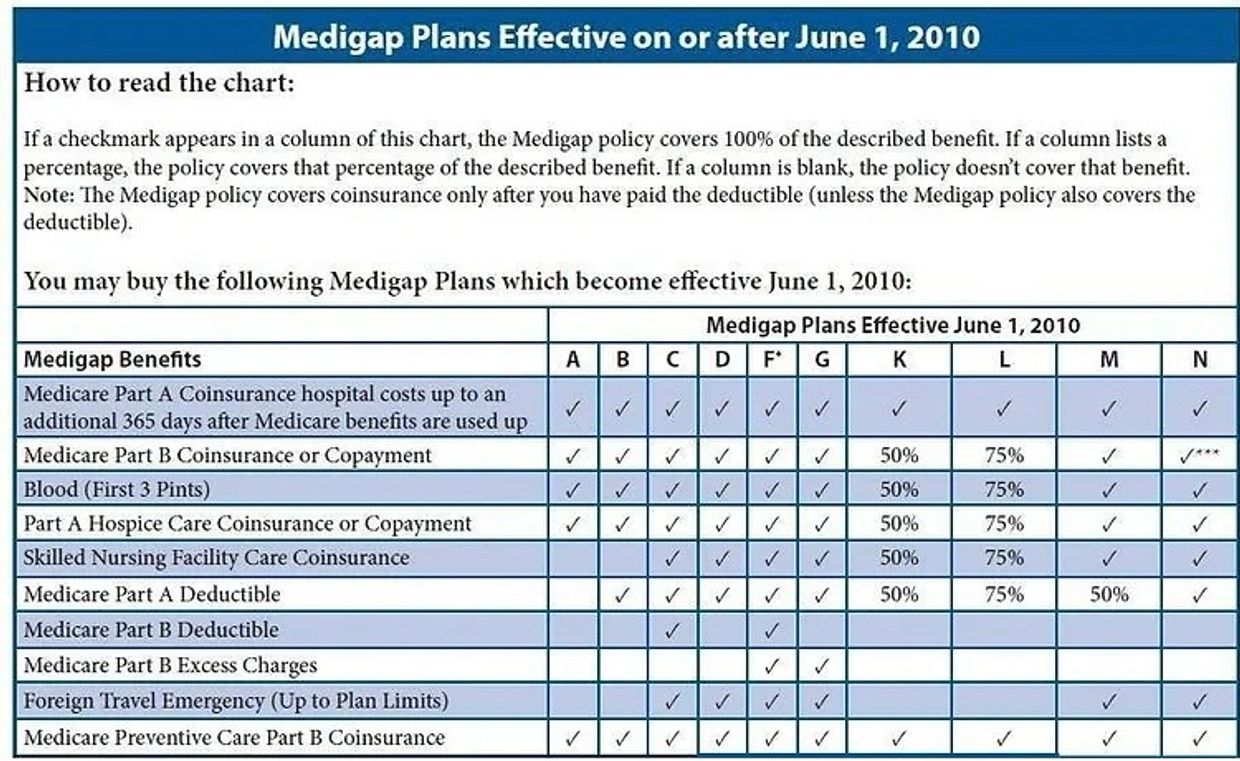

All Medigap policies in Florida (also known as a Medicare Supplement) must follow federal and state laws designed to protect you, and it must be clearly identified as "Medicare Supplement Insurance." Medigap companies in Florida can only sell you a "standardized" policy identified by the letters A through N. Each standardized Medigap policy must offer the same basic benefits, no matter which insurance company sells it. Cost is usually the only difference between the Medigap policies with the same letter sold by different insurance companies.

- You must have Medicare Part A and Part B.

- If you have a Medicare Advantage Plan, you can apply for a Medigap policy, but make sure you can leave the Medicare Advantage Plan before your Medigap policy begins.

- You pay the private insurance company a monthly premium for your Medigap policy in addition to the monthly Part B premium that you pay to Medicare.

- A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

- You can buy a Medigap policy from any insurance company that's licensed in your state to sell one.

- Any standardized Medigap policy is guaranteed renewable even if you have health problems. This means the insurance company can't cancel your Medigap policy as long as you pay the premium.

- Some Medigap policies sold in the past cover prescription drugs, but Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage. If you want prescription drug coverage, you can join a Medicare Drug Plan (Part D)

- It's illegal for anyone to sell you a Medigap policy if you have a Medicare Advantage Plan without the intent of replacing the policy

- Medigaps are not HMO or PPO plans. You can go to any Doctor, any Hospital, anywhere in the USA that accepts Original Medicare. Without referrals.

- Plan F is only available to those eligible for Medicare prior to 2020

Contact Us

Click the button below to request more information.

A pre-filled email will show up.

We will just need you to provide a name, location, and best way to contact you, to begin helping you.

Medicare Supplements in Florida Explained

Is a Medicare Supplement right for you? Download our free questionnaire to find out!

Is a Medsupp Right for you Questionaire (pdf)

DownloadLearn about the Different Plans

D&D Insurance LLC, DBA: Florida Medicare Broker

No obligations. No pressure. No Games. We just want the opportunity to earn your business.

Give us 5 minutes of your time. Call 352-217-1000 Don't like phones? Email us here. We will not spam. But we do ask for your email address so we can help you.

Copyright © 2024 D&D Insurance LLC, DBA Florida Medicare Broker - All Rights Reserved.

This Website serves as an invitation for you, the customer, to inquire about further information regarding Medicare Advantage and Medicare Supplement insurance, and your call will be routed to a licensed agent who can provide you with further information about the insurance plans offered by one or more of our third party partners. Submission of your contact information constitutes permission for an agent to contact you with further information, including complete details on cost and coverage of this insurance.

We and the licensed agents that may call you are not connected with or endorsed by the U.S. Government or the federal Medicare program. Medicare has neither reviewed nor endorsed the information contained on this website. This is not a complete listing of plans available in your service area. For a complete listing please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www. medicare .gov, , or your local State Health Insurance Program.